The Unfair Advantage The Power Of Compounding Hello my dear friends, I hope you all are d...

The Unfair Advantage

The Power Of Compounding

Hello my dear friends, I hope you all are doing well. Today I will discuss how compounding works & why everyone must use this in their investment journey.

So let's start Investing With Ease.

➤ Before we get into the subject, I said here that compounding is an unfair advantage but why? After reading this full blog you can understand why I am telling this.

Here is a quote over the power of compounding by Albert Einstein,

Compound Interest is the eighth wonder of the world. He who understands it, Earns it...He who doesn't... Pays it.

⦿ We all know, if we start investing early it will benefit us in the long run, and everyone says that at a young age we can invest in riskier assets because if we get good returns on them the capital will increase very fast and after that, we can transfer money from our riskier assets to a safer asset.

But why everyone says that? Here comes the power of compounding. Compounding can work in both directions(positive & negative), it can give us an enormous profit on our invested capital also it can enormously destroy our capital.

🟦 Here I will talk about compounding in Stocks, Mutual Funds, etc.

🔷 We must remember that FD(Fixed Deposit) works on simple interest. So if you are investing in FD then you are missing out on the power of compounding.

⦿ What is Compounding?

Compounding is the process where an asset's, earning from capital gains or from interest, are reinvested in the same asset to generate additional earnings from the asset over time. This growth is calculated using exponential functions because the investment will generate earnings from both initial capital and the earnings till now from the preceding periods.

That's why if we plot the graph of simple interest then we will find a linear line and in compounding, we will get the exponential line.

Now we must know that compounding works on both assets and liability.

Example: If we check credit cards bills, it is a liability for all of us. And the compounding on liabilities works on credit cards bills. We will see how it works in the next point.

⦿ How Compounding works on Investments?

Before understanding this we have to know some formulas from our schools.

1) Simple Interest = Principal * Rate * Time

2) Compound Interest = A = P(1 + r/n)^nt (Final Amount = A, Principal = P, r = rate of interest, n = number of times interest applied per time period, t = number of time period elapsed)

As we have seen above compounding is getting interest over interest. So if we take an example of two persons.

➤ Example:

One who has a fixed deposit of ₹10,000 in a bank with 7 % yearly returns for 5 years then his returns will be ₹13,500 after 5years.

Where the other person who invested in an asset which gives him 7% annually compound returns with the same principal amount, and if he invested it for 5 years then his returns will be ₹14,025(approx).

Let's take a longer horizon for 20 years with the same example, then the first person will get ₹24,000 & the second person will get ₹38,696(approx).

Here you can see the clear differences.

➤ Now if compounding works negatively:

If we see the credit card's monthly interest rate it is likely 2 to 4%.

Now if we have a credit card debt of ₹10,000, and we are paying ₹1000 per month & a 3.7% monthly interest rate then, we have to pay a total of ₹12,720(approx) and it will take 13 months to pay off full bill payment.

⦿ How Compounding works in Stocks or MF:

In stocks or mutual funds compounding never works as a good smooth exponential graph because in real life daily the values and the stats changes and there are many things that can affect the market.

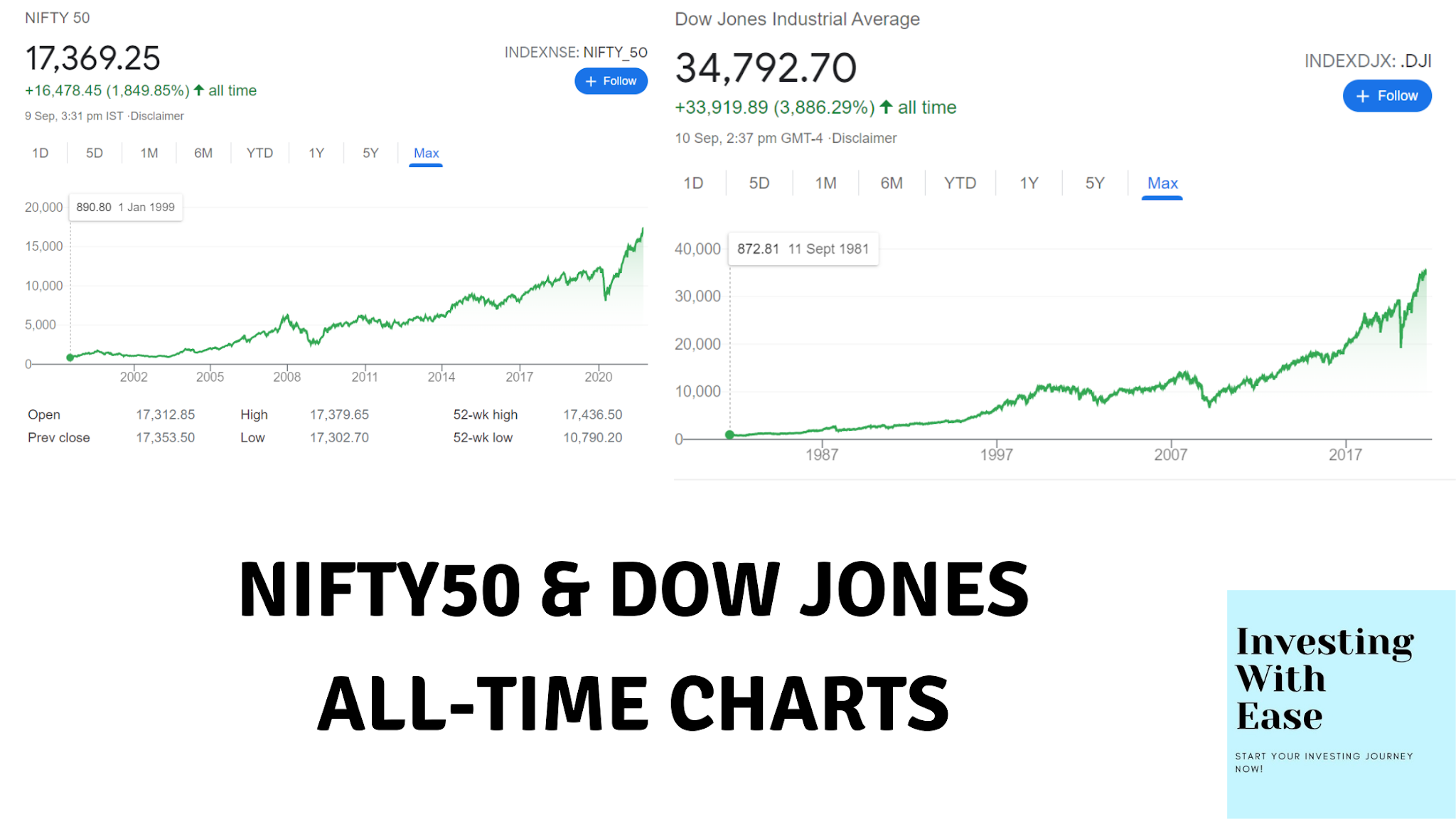

Here I am taking the charts of two well-known stock exchanges:

🠞 To calculate the returns we use CAGR(Compounded Annual Growth Rate). With this methodology, we easily calculate how our assets have grown yearly because in a year one month a stock or a mutual fund can deliver you negative returns, and in the next month the same stock or the mutual fund can deliver double returns.

So for our own calculation, it is a really simple method to calculate the returns and with this method, we can easily check how our assets are compounding with time.

⦿ Unfair advantages of Compounding:

▶ $81.5 billion of Warren Buffett's $84.5 billion net worth came after his 65th birthday.

From this example, we can easily understand that compounding takes our time and test our patience.

Everybody knows the success of Warren Buffett but no one discusses why he is successful today. He is successful not only because he generates good yearly returns but he generates good yearly returns for the last 4 decades. Warren Buffett started investing when he was 10 years old so if we see he is investing for more than 5 decades.

🠞 Now if take a normal person who starts earning from his/her mid-20s. Now if he starts investing from then, first of all, we are not always choose good stocks or mutual funds so with that conditions if he makes 15% annual CARG returns and if we assume normal people invest ₹10,000 monthly when he will retire(60years age) he will get ₹14,67,71,802.

Now take the same example for 40years of investing then returns will be ₹31,01,60,548.

Here you can see the huge difference in returns just for 5 years less investing period.

That is why many people say the unfair advantage of compounding.

➤ Tip: I must suggest you start early in your investment journey because it takes time and effort as well. Most of us may not be born in a family-like which has very deep knowledge over investing and managing money, that's if we have to learn on our own then it's quite difficult to choose a good investment asset for our own, and it takes time to learn investment strategies.

⦿ Caution: As I'm saying you to start early, that not means that you have to sacrifice your present happiness and invest it for your future. Investing is only worth it if at last we are happy in our life and feel secure financially. Investing is for the future but we also have to live our present.

I am telling this because nowadays most of the youngsters are starting investing without knowing the moto of investing. There is no value in investing if we are not happy in our present. So don't sacrifice your present happiness for your future, we have to be happy in our present and then invest your money for your future that will make you happier.

➤➤That is it for today guys. We will see you in the next blog, and I will try to post as fast as I can. Till then bye-bye & happy investing😃😃.

Editor: Sk Elaf Ahmed.

It is really an important topic and you have done a great job.

ReplyDeleteVery good and sensible writing

ReplyDeletekeep it up brother...

ReplyDeletebit.ly/3CRKahA

Keep it up

ReplyDeleteVery inspiring

ReplyDeleteThank you!

DeleteKeep uploading these kinds of contents.

ReplyDeleteKeep growing

ReplyDelete